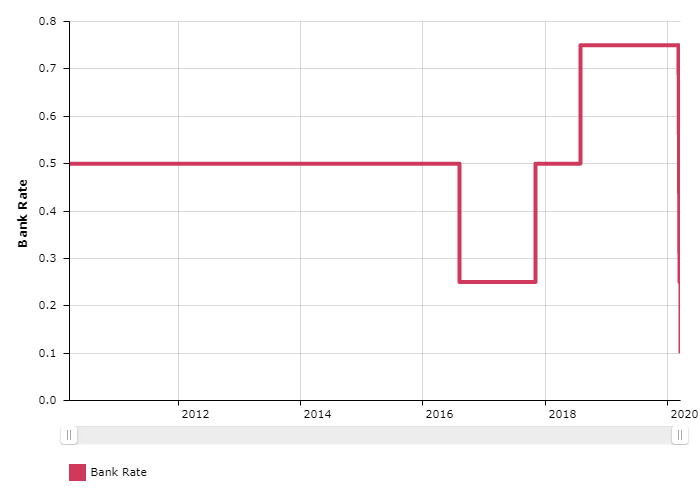

The Bank of England has once again cut interest rates in an emergency move to shore up the UK economy in the wake of the Covid-19 pandemic.

This is the lowest interest rate in the history of the Bank of England.

The Bank is also looking to restart its Quantitative Easing measures, by increasing its holdings of bonds by£200bn.

It was just last week that the Bank of England moved to reduce rates to 0.25%

Get In Touch – Live Chat

We have already been speaking with our own customers about this, but we have also spoken with new clients who would like to revisit their finances and compare their current mortgage rates to the already extremely low rates on offer from the 90+ mortgage lenders we have access to.

We have a Live Chat facility on our website that can help answer your questions.

Post from Thameside Mortgages